Support ICN

About the fund

ICN Creactive funds works to finance, develop and promote an #ATM culture that draws on developments in the business world and the use of creative and artistic processes in all their forms to contribute to:

- Taking positive action on ecological and societal transitions

- Introducing more ‘creative’ and ‘plastic’ ways of thinking

- and anchor its practices in the reality of citizens and the many families to which they belong: schools, associations, businesses, institutions, society.

As part of these missions, ICN Creactive Funds brings together a community of economic players committed to societal issues, keen to help raise awareness, train and equip future generations to be active and enlightened contributors to economic and social life.

Creactive funds, as ICN's endowment fund, is responsible for the day-to-day administrative and financial management of donations from corporate sponsors and individual donors, as well as research programmes. Its main missions are to promote ATM culture (combining cultures = Art + Technology + Management) to the world of business and future workers, to create a community of committed players, and to transform donations and research work into visible, embodied activity: student bursaries, entrepreneurship awards, conference-debates, and awareness-raising workshops.

Solidarity with students through tuition grants and prize awards is an important and ongoing activity of the endowment fund.

Legal status

ICN Creactive funds is the ICN BS endowment fund governed by article 140 of the 2008 Law on the Modernisation of the Economy.

Our events

Mandarin hours

We are both promoters and artisans of Les Heures Mandarines. These are conferences with great bosses and passionate people, and a time dedicated to debate intended for our partners, the ICN family and beyond.

This is a nod to the school's colours and a little reminder to your happy hearts at this time of day when the orange colour of the sky calls us for a moment of exchange around a conference-debate and a drink to share on the ICN BS roof terrace in La Défense.

In 19th century in China, Mandarin hours were the hours when friends were received with as many privileges as their own families.

Our conferences ‘mandarin hours’ are a place for debate on societal issues, located in La Défense, to open minds to ways of thinking about the individual in his environment, with its multiple families of belonging: family in the literal sense, association, business, society, etc.

Hoping this awakens the Mandarin in you.

Some references we like about mandarin hours:

- This is the name of the liqueur created by Antoine-François de Fourcroy, Comte d'Empire, Napoleon 1st's chemist, the Mandarin Napoleon.

- Thierry Marx, a decision-maker who meditates and former head chef at the Mandarin Oriental, says ‘Put love and friendship at the heart of your management’.

Choose your payment method

- Credit card

- Monthly withdrawal

- Chèque (order "Fonds ICN")

- Bank transfer

Return it (if necessary) to

Fonds de dotation ICN

86 rue du Sergent Blandan

CS 70148

54003 NANCY Cedex

Your tax benefits

IFI 75%

75% of your donation can be deducted from your property wealth tax, up to a maximum reduction of €50,000.

So a donation of €30,000 will actually cost you €7,500, after tax deduction.

Please note: please let us know if you are making your donation for the IFI deduction (formerly ISF). Your tax receipt will then be sent to you by ICN Business School.

IR 66%

66% of your donation from your income tax (IR), up to a limit of 20% of your taxable income.

So a donation of €1,000 really does cost you €340, after tax deduction.

IS 60%

60% of your donation from your company's corporation tax (IS), taken within the limit of €20,000 or 5‰ of turnover when the latter amount is higher.

Thus, a donation of €25,000 comes to €10,000 after tax deduction.

Our recognition programme

This programme is based on your commitment, donation or cumulative donations over the period 2016-2022. Each donor benefits from the privileges of the circles below their own.

For all loyal donors (minimum 3 consecutive years)

- Mention of your name in the fund's annual activity report

- Subscription to the ICN endowment fund newsletter

Major donors

- special mention on the donor wall

- You can associate your name with a project or a classroom

Benefactors

- Opportunity to become a member of the Board of Directors of the ICN Endowment Fund

- Acknowledgement of your support in the annual donor press release

- Invitation to the annual donor dinner

Supporters

- Submission of the annual activity report of the ICN endowment fund

- Special mention on the donor wall

Download the 2023-2024 activity report

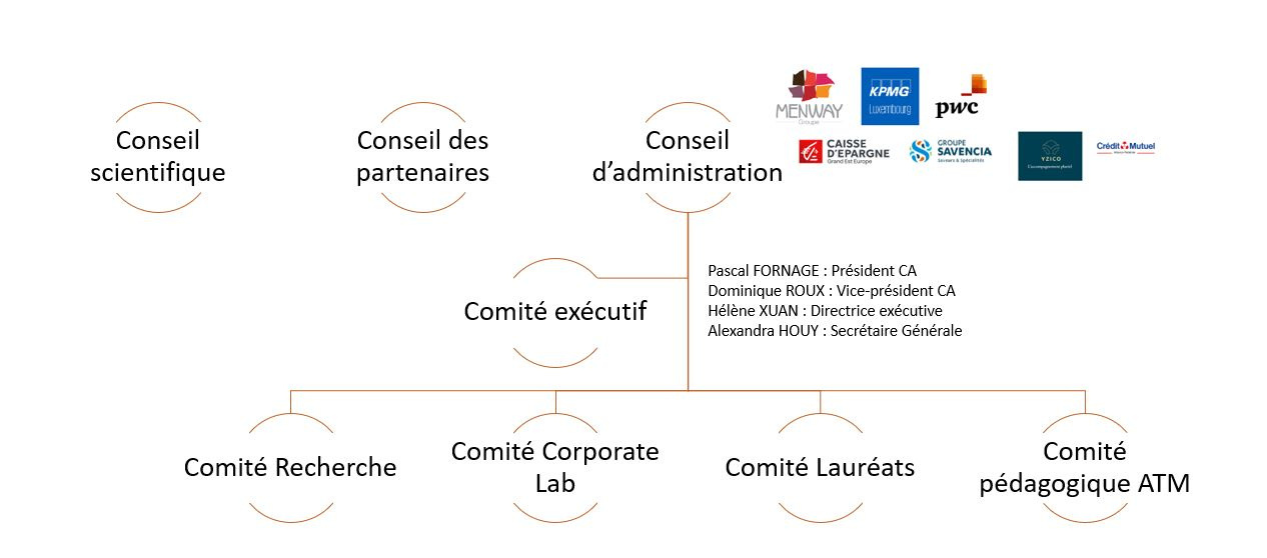

Our organisation chart